~Designing optimal, multi-faceted strategies for each company in an era of emissions allowance shortages~

Green Carbon Inc. (CEO: Jun Okita, hereinafter “Green Carbon”), which develops a nature-based carbon credit generation and sales business, has launched a corporate-focused “Emissions Allowance Consulting” service (hereinafter, the “Service”) in anticipation of the full-scale implementation of the GX-ETS (emissions trading system).

The Service aims to position emissions allowances and carbon credits not as something to be procured only when needed, but as an integral part of mid- to long-term management and GX strategies, providing support to both companies that purchase and offset emissions allowances and those that create and supply them.

◆ With the full-scale implementation of the GX-ETS, the environment surrounding emissions allowances is undergoing significant change.

The GX-ETS is expected to enter its second phase in fiscal year 2026, marking the start of full-scale operation as an emissions trading system. In particular, toward the end of 2025, a draft of the Act on Promotion of a Smooth Transition to a Decarbonized Growth-Oriented Economic Structure (hereinafter, the GX Promotion Act) is scheduled to be released. Under this draft, companies with emissions of 100,000 tons or more would be required—if they fail to meet their emissions targets—to offset the shortfall with emissions allowances or carbon credits, and if that is also difficult, to face mandatory penalties. As a result, carbon pricing and emissions allowance management are expected to advance, and the supply–demand environment for emissions allowances and carbon credits is becoming increasingly tight and highly uncertain compared with the past.

In addition, the existence of a banking system and the potential introduction of a so-called “unredeemed equivalent charge” (tentative name)—a payment that would be required if companies are unable to surrender emissions allowances corresponding to their actual emissions—are making the idea that “any shortfall can simply be procured from the market as needed” increasingly untenable.

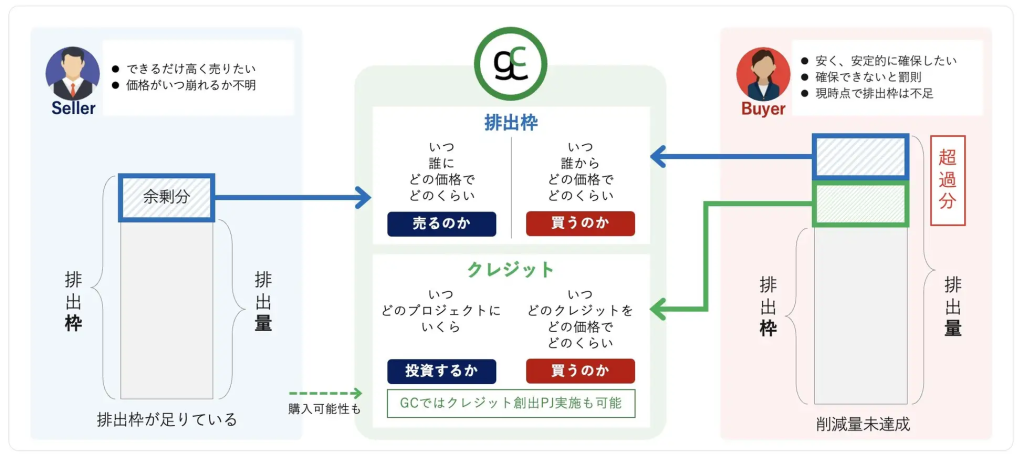

In the evolving regulatory environment, decisions such as those outlined below regarding emissions allowances and credits will directly impact companies’ cost structures and their GX strategies themselves.

- When to purchase or sell

- Which schemes to utilize (emissions allowances, J-Credits, JCM, etc.)

- At what price range and in what volume

- How market prices for emissions allowances and credits will evolve

On the other hand, because emissions allowances and credits are highly influenced by market conditions and policy design, approaches based on a single assumption carry an increasing risk of being insufficient to address future supply–demand tightening and price volatility.

◆ Green Carbon’s Emissions Allowance Consulting

In Green Carbon’s Emissions Allowance Consulting, we leverage the knowledge and insights we have accumulated to date, together with robust market analysis, to design strategies tailored to each company by combining its specific untenable with market and industry conditions and future outlooks—developing strategies based on all possible scenarios.

By integrating a wide range of factors such as those outlined below, we visualize multiple scenarios to show what outcomes can be expected under each strategic option.

- Simulations of multiple cases based on projected emissions volumes (t)

- Forecasts of price ranges for emissions allowances and carbon credits

- Design of mid- to long-term trading strategies for emissions allowances

- Procurement strategies for credits, including purchasing, creation, and investment

- Carbon pricing design based on market analysis

We do not present a single “correct” answer. Instead, we place emphasis on organizing the range of options available to each company and the outcomes associated with those options, enabling the design of the most suitable strategy.

In addition, Green Carbon goes beyond strategy design for emissions allowances and carbon credits by handling everything end to end—from planning and executing actual credit creation projects to the sale and brokerage of credits. A key feature of this service is the ability to translate strategies developed through consulting into real-world procurement, creation, and transactions.

◆ Multidimensional support grounded in a deep understanding of both sellers and buyers

This service is designed not only for companies that purchase and offset emissions allowances, but also for those that create and supply emissions allowances and carbon credits. Leveraging its hands-on experience in developing and selling nature-based credits, Green Carbon supports the design of emissions allowance strategies that are implementation-oriented and grounded in the perspectives of both the demand and supply sides.

As the market shifts from an era in which emissions allowances were “abundant” to one in which they are becoming “scarce,” Green Carbon will roll out this service as a partner that supports corporate GX strategies from the perspective of emissions allowances—bridging institutional understanding, project implementation, and market practice.

○Service Overview

○Contact Information:info@green-carbon.inc

◆ Provision of Educational Content on Emissions Allowances and the GX-ETS

In addition to providing Emissions Allowance Consulting, Green Carbon also offers “Green Career Academy,” an educational content platform that enables systematic learning—from the basic concepts of the GX-ETS and emissions trading systems to key issues in corporate practice.

The content covers fundamental decarbonization topics such as “What is the GX-ETS?” and “How are emissions allowances and J-Credits utilized?”, as well as the latest regulatory developments and practical considerations. Through this, Green Carbon provides information that helps companies deepen their understanding in light of their own specific circumstances.

〇Click here to view/download the Green Career Academy overview materials

As the regulatory and market environment surrounding emissions allowances grows increasingly complex, Green Carbon will advance initiatives that combine consulting and educational content—positioning itself as a partner that supports companies from both perspectives of learning/understanding and strategic design.

\February 3 – One of Japan’s Largest Carbon Credit–Focused Forums: Registration Now Open/

— From decarbonization as a mere “initiative” to a driver of corporate strategy —

One of Japan’s largest carbon credit–focused forums, the “Carbon Credits Journal Forum,” will be held on Tuesday, February 3, 2026, at Tokyo International Forum B7 (directly connected to Yurakucho Station).

We sincerely look forward to your participation.

〇Click here to register for this forum

〇Click here to visit the event’s special page

◆ Green Carbon ,Inc.

Representative: Jun Okita, CEO

Head Office: PREX North 9F, 2-3-2 Kojimachi, Chiyoda-ku, Tokyo, Japan

Established: December 2019

Business Activities: Development and sales of carbon credits, agriculture-related projects, environmental projects, other related businesses, and ESG consulting

Website: https://green-carbon.co.jp/en/

◆ About Green Carbon

Guided by the vision of “Harnessing the power of life to save the Earth,” Green Carbon develops and supports projects that generate, register, and sell nature-based carbon credits both in Japan and abroad. The company is also engaged in agriculture-related businesses, R&D initiatives, and ESG consulting.

Its business activities span Japan, Southeast Asia, Australia, and South America, creating credits from rice paddies, biochar, forest conservation, carbon farming, mangrove planting, and cattle methane reduction. In Japan, Green Carbon obtained certification in FY2023 for the country’s first and one of the largest-scale rice paddy J-Credit projects (approx. 6,220 t). In FY2024, the company plans to expand this initiative to around 40,000 ha (approx. 80,000 t).

Green Carbon also provides “Agreen,” a one-stop platform service that streamlines the entire process of credit registration, application, and sales. By simplifying procedures and documentation, the service reduces the administrative burden on credit creators.

◆Green Carbon’s social media

Youtube :https://www.youtube.com/channel/UCYO4WnGOHDaVB1ikxheZasA

note :https://note.com/green_carbon/

Facebook:https://www.facebook.com/profile.php?id=61557429326458

X :https://mobile.x.com/GreenCarbon2019

Linkedin :https://www.linkedin.com/company/green-carbon-inc/

Wantedly:https://www.wantedly.com/companies/greencarbon2019