Aiming to establish projects utilizing JCM through seeking local African companies and investment partners

Green Carbon, Inc.(CEO:Jun Okita、hereafter referred to as Green Carbon)is pleased to announce its participation in the African Development Bank’s African Investment Forum Market Days 2024 (hereinafter referred to as the “event”), held in Rabat, Morocco, from December 4th to 6th, 2024.

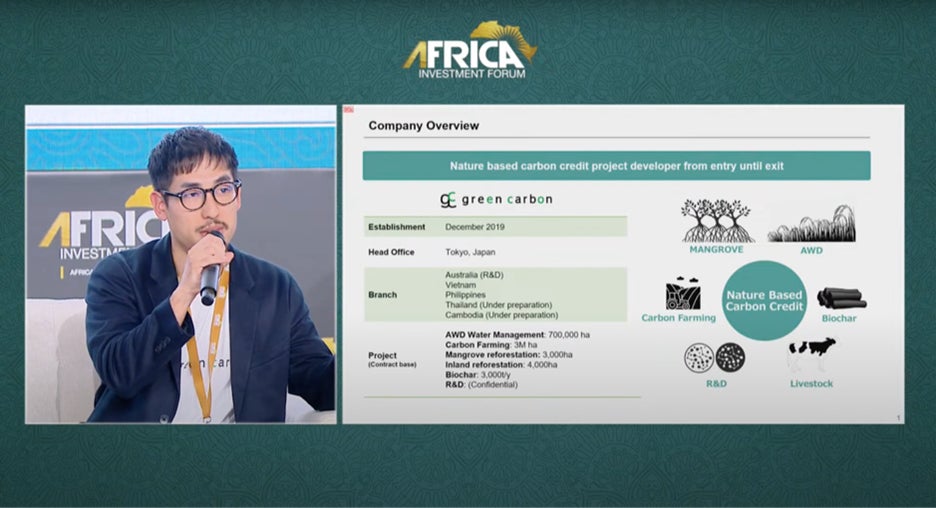

At the event, Green Carbon introduced its effort to harness Africa’s potential in generating nature-based carbon credits and discussed its initiatives to address challenges related to credit creation.

〇 Refer below for inquiries about this project/release content

○ Refer below to download Green Carbon’s company profile

◆ Overview of the Africa Investment Forum Market Days 2024

This event is a cross-sector investment promotion platform established in 2018 by the African Development Bank (AfDB) and seven other development financial institutions. It aims to connect investors, project implementers, and government officials across various sectors, including infrastructure, energy, agriculture and technology, to create investment opportunities and build networks in support of achieving Africa’s Sustainable Development Goals (SDGs).

This year’s theme, “Leveraging Innovative Partnerships for Scale”, focused on expanding new investments opportunities in Africa. Green Carbon participated in the session “Japan Special Room 2024,” a side event organized by the AfDB’s Asia Representative Office, which was held on December 5th, 2024.

○ Pitch Presentation(Global Sourcing Division Manager Ryo Harada)

Access below to stream archive:

※Green Carbon presents from 6:20:00〜

◆ Details of Green Carbon’s Presentation

During the event, Green Carbon introduced the challenges involved in carbon credit generation and presented its approach to addressing these issues. In particular, leveraging the expertise accumulated through its projects in Southeast Asia, Green Carbon proposed solutions to the challenges faced by the agricultural sector in Africa. These proposals include the following:

| 1. Potential for carbon credit generation in Africa |

|---|

| Africa possesses vast land, diverse ecosystems, and abundant forest resources, offering significant potential for carbon credit generation. While rich in natural ecosystems such as forests and savannas, the continent is also facing climate change risks, including droughts, floods, and desertification, which had led to an increasing interest in solutions to mitigate these challenges. |

| 2.Challenges and approaches to solutions |

|---|

| Currently, Africa faces several obstacles in the creation of carbon credits, including a lack of funding, technical expertise, inadequate institutional frameworks, and political risks. To address these challenges, Green Carbon plans to collaborate with local partner to provide necessary funding for initial investments and maintenance, as well as offer technical assistance and knowledge transfer to ensure success. |

| 3.Proposal for nature-based carbon credit generation |

|---|

| Green Carbon proposed specific initiatives for generating carbon credits in Africa, focusing on the following strategies: 【Rice paddy project】Africa has approximately 12 million hectares of rice paddies, with significant potential for introducing AWD (※1) technology, especially in irrigates paddies. 【Biochar project】There is also great potential in biochar (※2) projects that utilizing agricultural residues. In Africa, agricultural residues from crops such as coffee, corn, cocoa, and sugarcane remain unused. Additionally, according to a World Bank report, approximately $4 billion worth of grains are discharged post-harvest each year (※3), highlighting the growing issue of agricultural waste. By utilizing these underused resources as biomass, carbon credit can be generated. Furthermore, the resulting biochar can be used as a soil amendment, offering the added benefit of acting as a substitute for fertilizers. 【Other projects】The regeneration of mangroves, reforestation activities, and other carbon farming projects also have the potential to create carbon credits, while contributing to the efficiency and decarbonization of Africa’s agricultural and forestry sector. |

○Group Photo of Session Presenters

○Panel Discussion

◆Future outlook

Green Carbon aims to accelerate decarbonization projects in Africa’s agricultural sector by leveraging the expertise gained from its work in Southeast Asia. We will focus particularly on methane gas reeducation projects in rice paddies and biochar projects, promoting carbon credit generation through collaboration with local partners and companies.

Additionally, Green Carbon is developing a platform called “Agreen,” which will provide a one-stop service for carbon credit registration, application, and sales. By fully utilizing Green Carbon’s technology and know-how, we will not only advance decarbonization but also contribute to solving social challenges such as improving farmers’ income, enhancing agricultural productivity, and preserving biodiversity in Africa.

To accelerate these efforts, Green Carbon is focused on strengthening partnerships in the following three areas:

| 【Collaboration with local partners】 |

|---|

| Green Carbon will strengthen partnerships with effective local partners. The companies particularly interested in collaborating with businesses involved in reforestation activities, companies with networks of irrigates rice farmers, and developers seeking to enhance their expertise in carbon credit sales. |

| 【Developing investment partnership】 |

|---|

| The company aims to expand partnership with companies and investors interested in purchasing or investing in carbon credits, thereby scaling up its carbon credit generation projects. |

| 【Policy development】 |

|---|

| Currently, Kenya, Tunisia, Ethiopia, and Senegal are partner countries for the Joint Crediting Mechanism(JCM※4). There is anticipation for further expansion of partner countries. Additionally, inquiries from companies about investing in projects in JCM partner countries are increasing. As the system continues to develop, there will likely be more opportunities to implement projects. |

◆Overview of the Africa Investment Forum Market Days 2024

This event is a cross-sector investment promotion platform established in 2018 by the African Development Bank (AfDB) and seven other development financial institutions. It aims to connect investors, project implementers, and government officials across various sectors, including infrastructure, energy, agriculture and technology, to create investment opportunities and build networks in support of achieving Africa’s Sustainable Development Goals (SDGs).

This year’s theme, “Leveraging Innovative Partnerships for Scale”, focused on expanding new investments opportunities in Africa. Green Carbon participated in the session “Japan Special Room 2024,” a side event organized by the AfDB’s Asia Representative Office, which was held on December 5th, 2024.

〈Event Details〉

Organizer:African Development Bank(AfDB)

Co-organizers:African Export-Import Bank (Afreximbank) , African Finance Corporation(AFC) , Africa50, Development Bank of Southern Africa(DBSA) , European Investment Bank(EIB) , Islamic Development Bank(IsDB) , East Eastern and Southern African Trade and Development Bank(TDB)

Date:December 4th (Wednesday) ~ 6th (Friday), 2024

Location:Rabat, Morocco

Session:Digitalization and Agriculture for Sustainable Development

Target Audience:Companies interested in decarbonization activities in Africa, companies working on carbon credit generation, and investors

URL:https://www.africainvestmentforum.com/

※1:AWD (Alternate Wetting & Drying)

AWD is a technique that involves periodically flooding and naturally drying paddy fields based on the water level. Compared to continuous flooding, AWD can reduce water usage and contribute to the conservation of water resources.

※2:Biochar

Biochar is a carbonized material produced by heating biomass (organic material derived from living organism) in an environment with limited oxygen. The carbon that is fixed during the biochar creation process remains stable for an extended period, making it an effective means of reducing atmospheric CO2. Additionally, when returned to the soil, biochar can be used as a soil amendment, and carbon credits can be generated based on the amount of greenhouse gas reductions achieved during this process.

※3:(reference)World Bank Group. Stemming Post-Harvest Waste Crucial for African Food Security. https://www.worldbank.org/en/news/press-release/2011/05/31/stemming-post-harvest-waste-crucial-african-food-security

※4:Joint Crediting Mechanism (JCM)

JCM is a system where Japan promotes the adoption of its advanced decarbonization technologies and contributes to greenhouse gas emission reductions in partner countries. The reductions achieved are used to help both countries meet their emission reduction targets. This bilateral system, led by Japanese government, is established with partner countries, and as of March 2024, 26 countries are participating as partner nations.

◆Green Carbon, Inc.

Representative : Jun Okita, CEO

Location : Isal AKASAKA607, 5-2-33 Akasaka, Minato-ku, Tokyo

Establishment : December 2019

Business : Carbon credit creation and sales business, agriculture-related business, environment-related business, other related businesses and ESG consulting business

URL : https://green-carbon.co.jp/

◆ Introduction of Green Carbon

Green Carbon operates with the vision of “Saving the Earth with the Power of Life”, providing comprehensive support from carbon credit creation, registration, to sales. Additionally, we are involved in agriculture-related businesses, research and development, ESG consulting. Among others. Our main focus is on generation carbon credits through methane gas reduction in rice paddies, where we have obtained certification for J-Credits, the first and largest in Japan (approximately 6,220 tons), and plan to expand to around 50,000 hectares in the fiscal year 2024. We also offer a service called “Agreen” that integrates credit registration, application, and sales into one platform, simplifying procedures such as application registration and document preparation, thus reducing workload for credit creators.

◆ GREEN CARBON JAPAN VIETNAM COMPANY LIMITED

Abbreviation:GREEN CARBON JAPAN VIETNAM CO,. LTD

Representative :Jun Okita, CEO

Location:10th Floor, The Nexus Building, 34-3B Ton Duc Thang, 1, Ho Chi Minh City, Vietnam

Establishment : August 24

Businesses : Carbon credit creation and sales business. agriculture-related business